Here is a sample that showcases why we are one of the world’s leading academic writing firms. This assignment was created by one of our expert academic writers and demonstrated the highest academic quality. Place your order today to achieve academic greatness.

Variance calculation and conceptualization are critical for an organization to achieve its long-term goals and objectives. Understanding the potential causes of variance will enable a firm to establish good reporting techniques and ensure accountability. Variance calculation aids risk management since variance analysis provides finance executives with the information they require to comprehend the source of convenient and unmanageable deviations. This paper compares the budgeted profits, sales, and revenues to the actual costs, profits, recharges, and the number of jobs. The review then provides a comprehensive discussion of the firm’s performance and variables that determine the significance of a variance. It explains the rationale for including variance in the planning and operational elements of the firm.

i) the budgeted profits

The total budgeted profit is calculated by multiplying the average profit per job by available jobs.

Kitchens: total profit: 2000*4000 = 8,000,000

Bathrooms: total profit: 1500*2000 =3,000,000

Therefore the total budgeted profit in that year equals the addition of the profit from the kitchen and the bathroom.

Total budgeted profit (kitchen +bathroom) = 3,000,000 + 8,000,000 =11,000,000

ii) The actual profits

The actual profit is calculated by multiplying the average profit per job by the number of available jobs.

Kitchens: total profit: 2600*2500 =6,500,000

Bathrooms: total profit: 2500*900 =2,250,000

Therefore, the total profit in that year equals the addition of the profit from the kitchen and the bathroom.

Total actual profit (kitchen+ bathroom) = 2,250,000+ 6,500,000 =8,750,000

b) The variation between a company’s projected and actual sales price of a product or service is known as sales price variance. It can be used to establish which goods give the most to the entire sales income and to identify which products should be reserved or reduced in price (wood inch et al., 195). Furthermore, it depicts the difference in total revenue generated due to charging a different selling price than the planned or standard price. The price at which products or services are sold is not the same as the expected price. Increased competition, for example, may compel a corporation to lower its selling prices. it is calculated as the actual selling price – planned selling price

a) kitchens

The total price calculation is the number of jobs multiplied by the average cost per job.

Therefore, the total price: is 4,000*10,000 = 40, 000,000

Total direct costs: 5,500*4000 = 22,000,000

Total central service recharge: 2500*4000 =10,000,000

Total profit: 2000*4000 = 8,000,000

b) Bathrooms

Total price: the total cost calculation is the number of jobs multiplied by the average price per job.

Therefore, the 7,000*2000 =14,000,000

Total direct costs: 3000*2000 =6,000,000

Total central service recharge: 2500*2000 =5,000,000

Total profit: 1500*2000 =3,000,000

Total budgeted cost (kitchen+bathroom) = 40, 000,000 + 14,000,000 =54,000,000

Total profit (kitchen +bathroom) = 3,000,000 + 8,000,000 =11,000,000

The actual results:

a) Kitchen:

Total price: the total cost calculation is the number of jobs multiplied by the average price per job.

Therefore, the 2600*13000 =33,800,000

Total direct costs: 8000*2600 =20,800,000

Total central service recharge: 2500*2600 =6,500,000

Total profit: 2600*2500 =6,500,000

Orders completed by our expert writers are

b) Bathrooms

Total price: the total cost calculation is the number of jobs multiplied by the average price per job.

Therefore, the 2500*6100 =15,250,000

Total direct costs: 2500*2700 =6,750,000

Total central service recharge: 2500*2500 =6,250,000

Total profit: 2500*900 =2,250,000

Total actual costs (kitchen+bathroom) + central service division = 33,800,000 + 15,250,000 +17,500,000 = 66,550,000

Total actual profit (kitchen+ bathroom) = 2,250,000+ 6,500,000 =8,750,000

Therefore, the sales price variance = actual selling price – planned selling price

= 66,550,000 – 54,000,000

= 12,550,000

Profit variance is the difference between the actual profit experienced and the budgeted profit level. Therefore, the profit variances = actual profit – budgeted profit

= 8,750,000– 11,000,000

= -2,250,000

c)a bank reconciliation statement

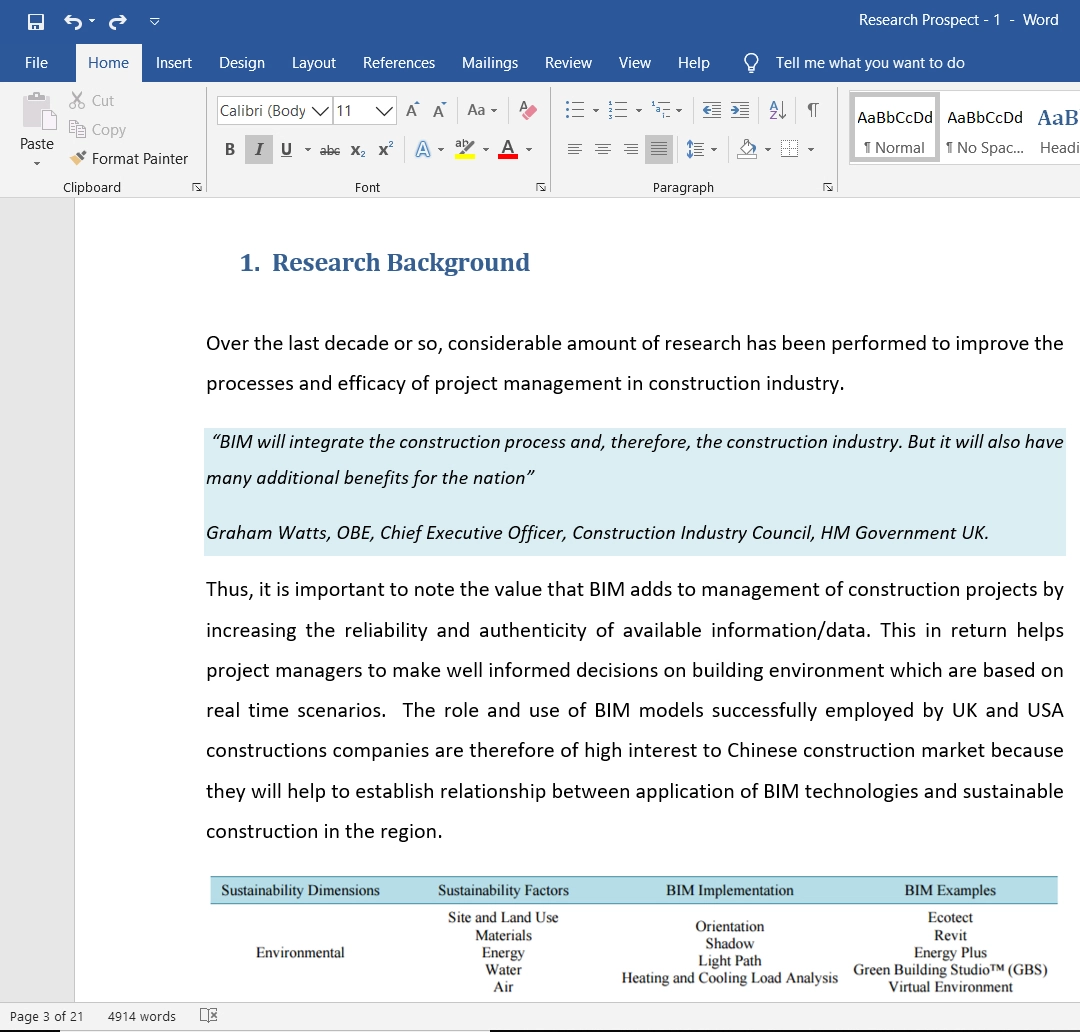

| budgeted | actual | |||

| kitchen | bathrooms | kitchen | bathrooms | |

| number of jobs | 4000 | 2000 | 2600 | 2500 |

| average price per job | 10000 | 7000 | 13000 | 6100 |

| average direct costs per job | 5500 | 3000 | 8000 | 2700 |

| central services charges per job | 2500 | 2500 | 2500 | 2500 |

| average profit per job | 2000 | 1500 | 2500 | 900 |

| total profit | 8,000,000 | 3,000,000

|

6,500,000 | 2,250,000 |

| total | 11,000,000 | 8,750,000

|

||

d) The computed profits from the bathrooms and the kitchen in the budgeted cost are higher than that of the actual budget profit. The company’s performance in terms of profit is negative. This means that the budgeted price is higher than the actual cost. The company makes a profit variance of -2,250,000 euros annually, meaning that it got losses during that period.

e) i) The statistics’ dependability and accuracy- mistakes committed when calculating budget figures or documenting actual expenditures and revenues can result in a variance being reported.

ii) importance- the variance size might reveal the problem’s scope and the possible gains and losses from its resolution.

iii) Possible variance interdependencies- a deviation in one area can sometimes be associated with a variance in another. For example, because the poorer grade textile is tougher to work with, a good raw material cost variation from acquiring a lesser grade of the material may create an undesirable labor effectiveness variance.

iv) The inherent fluctuation of the cost of revenue—some costs, such as oil prices, are naturally variable, and deviations are unavoidable. On the other hand, labour rates are significantly more constant, and even tiny variations can signal a problem (murwisi, para 5).

v) Variance trends- while a chance event may form a single unfavorable variance, a sequence of unfavorable variances regularly signifies that a course is unmanageable.

vi) Correction controllability- if the cause of price revenue is beyond the administrator’s control, there is slight or no purpose in looking into it.

vii) Correction expenses and profits- if the expense of fixing the crisis is going to be greater than the profit, there is minute use in looking into it further.

f) The advantages of analyzing existing variances into a planning and operational element

Variance studies enable an organization to be practical in attaining its business objectives, supporting in classifying and alleviating any possible threats, and eventually encouraging trust among team members to accomplish the expected. Furthermore, comparing the budget with the genuine result may disclose the need to reassess the company’s objective client foundation or product line, which aids in identifying necessary adjustments in the business plan (Covariates, 73).

Additionally, it aids in cost control by allowing organizations to define standards for every expense sustained and emphasizing exceptions or variances—i.e., Moments where issues did happen as intended. Variances serve as a preliminary spot for evaluating managers’ efficacy in managing the expenditures they are accountable for.

Presume that real direct materials expenditure of $ 52,015 at a production center surpassed standard costs by $ 6,015. The knowledge that real direct materials prices were $ 6,015 more compared to standard expenses is more valuable than the knowledge that definite direct materials costs were $ 52,015. Now the company may observe and conclude why actual expenses are more than standard costs and decide the way forward.

Additional research should be done to establish if the exception or divergence was brought by inefficient material use, increased prices due to inflation, or uneconomical acquisition. The typical price system acts as a premature caution system in any situation, informing the administration of a possible problem. As a result, more vital data is available for management planning and decision-making.

If the managing board develops satisfactory cost criteria and succeeds in controlling manufacturing expenses, prospective real prices should be near the norm. Due to this, management is capable of creating further practical budgets and anticipating operating costs to bid on activities with standard costs. Top management may gain from a single price system when setting up and deciding. It also makes inventory measurements more fair and straightforward. Under a definite cost system, unit costs for group batches of identical products could vary significantly.

This unpredictability can happen due to machine breakdown during a batch’s manufacturing, which raises the number of employees working and overhead salaried to that batch. In a standard cost system, such unexpected expenses are not indicated in the inventory. Rather, it charges the excess expenditures to variance financial records after contrasting real prices to typical expenses.

In a standard cost system, a corporation believes that every unit of a particular product created during a specific time frame has similar prices. According to logic, the same physical units created in a particular time period should be documented at a similar cost. It enables record-keeping expense investments. While the standard cost scheme may appear to need extensive record-keeping in the bookkeeping phase than a definite price system, this is not the procedure.

Expenditure transfers amid inventory accounts into the price of merchandise sold will be evident in a structure that merely looks into real costs. It keeps track of the amounts of actual unit expenses that should be calculated the whole time. A standard cost system shows how an organization’s costs move from financial inventory records to the price of supplies sold at consistent normal levels in time.

The actual unit costs for the time can be computed without additional calculations. Instead, businesses can produce ordinary cost sheets in advance that show standard amounts and unit prices for the materials, labor, and overhead needed to produce a definite product. As a result, future output decreases are possible. A standardized costing approach could result in cost savings.

If standard expenses are applied, staff may become more cost aware and seek improved ways to conduct their job. Employees must take active responsibility for cost cuts for a company to achieve meaningful cost management success. This approach helps the company know the total expenditure and revenue, enabling them to figure out whether they are making losses or profits. Exceptionally, this cost system is essential in large firms because it is less strenuous compared to other cost systems. Profit is essential for the company to grow and acquire more resources.

g) Disadvantages of analyzing existing variances into a planning and operational element

For starters, time is wasted, and delays occur because the accounting department collects variances at the end of each month before reporting results to management. Most of the time, management needs a much faster response. Thus it focuses on warning flags or measurements taken directly on ground. Second, it necessitates rigorous analysis because if financial planning is not done after a careful assessment of the main factors, the budgeting procedure may be chaotic and depart from actual numbers.

In this case, inspecting variances might not be sensible. Finally, the source of the differences is a hurdle. Accounting employees must examine data such as labor routings, bills of material, and overtime accounts to establish the sources of such discrepancies. A questionable materiality limit for deviations is also in place. It’s possible that establishing the material restrictions of the variations can be controversial. Every organization’s management is in charge for instituting what comprises a material or unanticipated disparity.

Establishing materiality borders can incur problems or differences due to the involvement of personal judgment. Non-reporting of certain differences is also a disadvantage. Workers might not report negative budget variations or can struggle to minimize these deviations to conceal incompetence if the managing board only investigates odd variances. Workers that are victorious in covering up deviations lessen the budgeting’s effectiveness. Some staff has low drive; hence the management by omission strategy is used to focus on the outliers. Administration often focuses on unconstructive deviations while neglecting positive variances.

Workers may presume that reduced performance gains more consideration than a good act. This leads to the decline in morale in the staff. Because firms must study deviations after calculating them to conclude, it is open to subjective interpretation. This procedure, however, may lead to personal elucidations. Equally, companies must develop thresholds for the diversities they would like to study.

This decision can also be subjective, leading to noteworthy disparities being overlooked. As a result, the process is pricey because it necessitates organizations going through a lengthy procedure. Another drawback is the application of standards. Companies must develop guidelines for every expenditure or income they acquire as a component of standard costing.

Companies need to adjust their standards on a usual basis to accommodate any modifications. In addition, variance analysis is a reactive tool distinct from other managing accounting techniques. As a result, this technology is unable to prevent any problem. After the problem is created, variance analysis can be used to discover it. While it is still beneficial for companies to do so, it can also lead to huge losses before discovering flaws.

As Covariates, B. M. I. (2018). Multivariate analysis of variance (MANOVA). Multivariate Statistics Made Simple: A Practical Approach, 73.

Chiu, C.H., Choi, T.M., Dai, X., Shen, B. and Zheng, J.H., 2018. Optimal advertising budget allocation in luxury fashion markets with social influences: A mean‐variance analysis. Production and Operations Management, 27(8), pp.1611-1629.

Murwisi, K., 2017. Impact of budgeting and budgetary control on financial performance of statutory bodies: A case of Upper Manyame Sub Catchment Council.

Wooditch, A., Johnson, N. J., Solymosi, R., Ariza, J. M., & Langton, S. (2021). Analysis of Variance (ANOVA). In A Beginner’s Guide to Statistics for Criminology and Criminal Justice Using R (pp. 183-208). Springer, Cham

To complete a master’s level coursework: