Disclaimer: This is not a sample of our professional work. The paper has been produced by a student. You can view samples of our work here. Opinions, suggestions, recommendations and results in this piece are those of the author and should not be taken as our company views.

Type of Academic Paper – Dissertation Proposal

Academic Subject – Finance and Accounting

Word Count – 4779 words

The financial service sector in the UK is has a significant contribution to the economy of the UK as it contributes around 10% of the total economy. The financial services industry in the UK is comprised of; banks, insurance companies, securities firms, related financial services such as auditing and accounting. The outcome of the EU referendum in the UK had major effects on the UK’s macroeconomy and financial services sector. The result of the EU referendum favoured Brexit as most UK nationals voted to exit from the EU. Because of being a member of the EU, the UK had passporting rights before Brexit. As per Miethe and Pothier (2016), the benefit of passporting is that “a financial institution licensed in the UK (the home country) is legally entitled to provide services in another member state (the host country) without needing any further regulatory authorization” (pp. 365).

The UK had single market access to the EU to carry out all the financial services within the EU while enjoying single market benefits. As a part of the EU, the UK was subjected to EU financial regulations rather than having some other arrangement to transfer financial services outside the UK. So before exiting the EU, the UK had voting rights and said in the development of EU financial rules. However, after Brexit, this right is no longer available to the UK, and it is possible that the EU financial rules will be modified for the UK now and will create problems for the UK financial services sector. This highlights that the UK’s financial services sector is likely to experience a major transformation likely to impact the industry in various dimensions.

Brexit had created uncertainty in the UK financial environment. The likely impact of it on the UK’s financial services industry has been a focus of researchers since then. Researchers have given special attention to finding the likely impacts of Brexit on the UK financial services and banking sector. The complexities which can occur in response to Brexit are discussed and debated by different researchers. Various researches have been performed to determine the effect of the decision on the UK’s financial services sector; the disadvantages and negative impact of Brexit are highlighted. However, future outcomes and negative impacts may not be obvious at the moment and may appear later. Therefore, research is still required to thoroughly analyze the future impacts of Brexit on the UK financial services sector once the withdrawal from the EU is completed, and new policies will be enforced to regulate the financial and banking transactions between the UK and the EU. Given this, the proposed research is useful as it is likely to light on the likely future outcomes of Brexit on the UK’s financial services sector.

This research aims to find the negative or positive effects of Brexit on the UK’s financial services sector. In this regards the key research question which will be answered in this study are as follows;

Given the aim of this research the research objectives are;

The account of existing empirical literature regarding the effects of Brexit on the UK financial services sector is provided in this section. It would be possible to identify how the proposed research would fill the existing literature gap and contribute to new understandings in that field.

A major discussion was raised on the UK financial services sector regarded the Brexit. It has become a critical matter for the UK financial services sector as the new relationship between the EU and UK is complex (Wyman, 2016). In terms of revenues, every year the UK financial services sector earns more than £200 billion as revenue and at the same time contributes more than £120 billion in the Gross Value Added (GVA). Moreover, the financial services sector provides more than 1 million employment throughout the country. Besides, it generates tax of more than £60 billion annually. Furthermore, the financial services sector enables the UK’s balance of payment to attain a trade surplus of around £58 billion. (London First, 2016)

While being a member of the EU, the UK financial services sector had to associate itself with major professional services bodies and had developed an interdependent and interconnected ecosystem (Wyman, 2016). The advantages of the ecosystem were that it contributed much towards the financial institutions and other corporations, serving in household activities. Since both the activities and firms were interrelated within the ecosystem, the UK’s exit from the EU has adversely affected many companies. On the other hand, its negative impact was also felt by the EU clients. (House of Lords, 2017)

The UK’s exit from the EU has kicked the UK economy completely out from the European Economic Area (EEA). As a result, certain kinds of disruptions were caused in terms of delivery passporting and equivalence, which had given the UK the single market access to the EU. This, in turn, brought some changes in the pre-Brexit financial services delivery model (House of Lords, 2017). In post Brexit period the UK-based activity anticipated only an average decrease. However, an estimate was made regarding the EU-related activities whereby revenues would fall by £2 billion. It is estimated that up to 4000 jobs would be at stake, and eventually, the annual tax revenues would also be reduced to £0.5 billion. (Wyman, 2016)

It was argued that without any regulatory equivalence, the UK status in the EU would be no more than a third country. It is anticipated that in the absence of regulatory equivalence, the negative effect of Brexit would be more severe on the UK financial services sector (Gannon, 2016). Severe restrictions are expected to be imposed on the UK based firms to do financial transactions with EU-related businesses. Nevertheless, the UK and EU relationship lies completely on the World Trade Organisation (WTO) obligations which are considered the lowest case scenario (Wyman, 2016). In response to losing regulatory equivalence, the EU-related activity can anticipate falling by more than 40 percent, which would worth around £20 billion of revenues. Moreover, due to the absence of regulatory equivalence, more than 30000 jobs would be at risk, while the tax revenue is expected to fall by around £3 billion annually. (London First, 2016)

Nonetheless, the relationship between the UK and the EU will surely take some time to adapt to their new legal role and engage in a new action plan towards the financial services regulatory system. However, based on this new resolution, it would be very critical to decrease financial stability risk. As a result, it would also adversely affect the growth and competitiveness of the countries. (Crafts, 2016)

Orders completed by our expert writers are

When the UK was a member of the EU, it enjoyed certain kinds of benefits in gaining single market access rights, being treated as the EU Treaties, ‘passporting’ and equivalence based on the rules and regulations. Furthermore, there are no additional requirements regarding the rights on passporting or even on a cross-border basis or through branches once being on the EU hub. When a country forms part of the European Economic Area (EEA) and is bound towards the EU legislation, there would be even no need for any extra local verifications (London First, 2016).

Nevertheless, this strategy will ensure that no states can misuse their passport rights by adding any extra rules and regulations on businesses. These passports have not been granted to the third country firms that are businesses outside the EEA. On the contrary, there are some kinds of third-country passports in the Markets of the Financial Instruments Directive II (MiFID II) and the Alternative Investment Fund Managers Directive (AIFMD), but which certainly have not yet been issued (London First, 2016). Once the Brexit, the UK would find itself outside the coverage of the EU. At the same time, it would be deprived of gaining any EU Treaties, and preferential terms are given only to the EU members while accessing the EU single market. (Crafts, 2016)

Accordingly, firms that trade between the EEA and the UK would even lose their passporting rights, freedom of service and freedom of establishment set by the EU Treaties and legislation (House of Lords, 2017). Furthermore, by gaining the standard of a third country, all assumptions regarding any regulatory equivalents regarding the EU financial services frameworks would be removed. As such, the UK-based entities would be treated under the ‘third country regimes’ established by the EU law (House of Lords, 2017). This, in turn, means that some kind of limited purpose would bound the country in terms of equivalence. Moreover, for equivalence to occur, it must first be requested, tested and affirmed whereby it would ultimately rely on the EU standards. However, it is not always that equivalence would be available for provision on services or servicing of client types. (Crafts, 2016)

When financial services firms are relocated, it is required that their licenses are issued following the jurisdictions of the new host country. According to the rigorous regulatory systems, it takes approximately six to eighteen months to be granted a new one. There might be some issues concerning the capacity; for example, if a huge portion of the sector wants to migrate immediately, it is likely to create a problem. For instance, the banking and clearing products would require risk models requiring authorization from the local bodies. Hence, the local regulators can take up to two years of dialogue to grant new licenses. (Wyman, 2016)

When a legal entity in different countries tends to move their business from one country to another, they are likely to encounter some difficulties in moving capital between legal entities. Before capital is released from one country to another country, the regulators demand proof that the capital is not required anymore. Given this, firms moving business between entities in different countries have to hold a double amount of capital than they should have for a certain time period. (Wyman, 2016)

The European supervisory authorities include multiple UK institutions that will collaborate with the national financial supervisors such as banks, insurance and securities markets. One among the EU’s supervisory authorities, namely the European Banking Authority, is situated in London. However, if Brexit takes place, there will be some negative impact on the regulatory system, consequently disrupting the term to trade. Thus, this situation is quite complicated when referring to the exact nature and relationship that the UK shares with the EU and how drastic things will change if Brexit occurs. (Wilcock & Miller, 2016)

Moreover, among many other EU members, the UK is the only one that attracts more Foreign Direct Investment (FDI). Besides, the financial services also contribute a huge proportion to attracting FDI compared to any other sector. Since 2007, foreign firms have invested more than £100 billion into the UK around half of the FDI was coming from outside the EU. As a result, if the UK selects to exit from the EU, the aftereffect would surely be felt upon Britain’s financial services industry. Consequently, the trade will be adversely affected, and hence, firms will lose their rights over the market in which they are operating. Additionally, the UK economy will suffer regarding their tax generated activities, especially while considering its size and importance. (Sahr, Compton, Carr, & Behrens, 2016)

The EU firms and governments have borrowed approximately $1.4 trillion from the British Banks. Besides, there are a huge amount of financial activities which are held outside the EU. At the same time, they are executed either directly or indirectly out of London. There is around 87% of the US investment banks, that is a good percentage of the EU employees working in London (Wyman, 2016). The UK can supply their goods and services around the rest of the EU without needing a license, regulatory approval, or local subsidiaries. This process is defined as passporting, which also incorporate British-based financial institutions, such as banks, insurance providers and asset management firms (Wyman, 2016). In collaboration with other important key factors, passporting was one of the biggest reasons why many financial institutions wanted to establish their main London offices.

Furthermore, it was found that approximately 5,500 companies in the UK depend highly upon passporting to conduct their transactions with the other parts of the EU. As such, this act of approach tends to flow both sides, whereby more than 8000 firms from the rest of the EU are trading in the UK via passporting (Wyman, 2016). However, a question recently asked was a will passport still be in the process if the UK exits from the EU (Wyman, 2016). Accordingly, the answer to this particular question is no. Consecutively, even the Swiss style will not fit in this scenario. It is nearly impossible for the EU or even Switzerland to grant the UK any such deal. As such, any country exiting from the EU will lose the rights of passporting. Thereby it is such a deal where even the Swiss government had discussed before entering the EU (Wyman, 2016).

Nevertheless, another major drawback of Brexit is concerned with uncertainty towards the regulatory system. In the past, the UK’s main strength was related to its regulatory system, especially while accessing the single market. Therefore, there are two main reasons how London has turned out to be the financial capital of the EU, and they are as follows:

But whilst this may have been a strength historically, Brexit complicates things considerably. First, Britain will need to replicate or renegotiate more than 40 years of EU regulations and trade deals. This will take a significant amount of time. And unfortunately, many financial services firms cannot afford to wait that long. To be clear, London is unlikely to collapse as a financial centre, but it seems inevitable that some, if not will move elsewhere lot, of the capital’s financial firms, will, unfortunately, it looks like it’s already happening. Investment banks have already begun shifting or preparing to shift, many of their back-office functions to other jurisdictions. And that affects a lot of people. (London First, 2016)

The literature review indicates that various researches have been performed on the effects of Brexit on the UK financial services sector. While testing the likely effect of Brexit on the financial sector in the short-run, Handley and Limão (2015) found that it is likely to create policy uncertainty in the post Brexit period. Armstrong and Portes (2016) researched the economic cost of leaving the EU and found that the UK has to face policy uncertainty in the financial services sector. It was suggested by Bush, Knott and Peacock (2014) that the banking system of the UK is one of the largest in the world. In the UK, the percentage of foreign bank assets in the total banking assets is highest globally. In the UK’s total banking assets, the foreign bank branches’ percentage of assets is more than 30 per cent. Bush, Knott and Peacock concluded that the non-EU FDI and other UK investments would be materially impacted due to losing the single market access to the EU financial markets.

One of the EU referendum’s effects was on the exchange rate of GBP (Gannon, 2016). Even before the exit decision was finalised, the exchange rate of GBP had started to decline. However, when the UK’s decision to exit from the EU was confirmed, the GBP had started to drop against USD and other currencies even more rapidly than before. The shocking news had resulted in David Cameron’s resignation, the Prime Minister of the UK, and it had negatively impacted the GBP exchange rate, making GBP further weaker. In a few days, the exchange rate of GBP against USD was at its lowest level in the last 30 years due to the devaluation of the GBP. This outcome of the EU referendum has already negatively affected the UK’s financial services sector. (Connington, 2017)

While analysing the international and European points of view on Brexit, Oliver (2016) had identified that the withdrawal of Britain from the EU would change the importance of Britain and the EU in the international financial system. Sampson (2016) had performed a study to estimate the changes in the trade costs in the post Brexit period. He argued that it is hard to predict how the UK and EU relations will be altered after Brexit. However, he suggested two possible scenarios (soft and hard Brexit). He suggested that trade costs will increase greatly in the hard Brexit case, while the trade costs may not increase greatly and will be sustainable in the soft Brexit case.

A study by Miethe and Pothier (2016) focused on finding out what will be at stake for the UK financial services sector in response to Brexit. They have also suggested that the UK financial services sector will have far-reaching impacts due to Brexit. Presently the financial hub of Europe in London, and due to single market rights, the UK financial institutions availed this benefit to provide services freely without Europe. There were two major benefits of having single market access first, the European banks could conduct wholesale banking activities in the UK and EU. Moreover, for non-European capital to enter Europe, London and the UK were the major entry point. Upon exiting the EU, the UK will no longer have the single market rights, and the two major benefits of having single market access will be reduced greatly if not lost completely. To compensate for the lost benefit of single market access, the UK may develop greater integration with offshore and overseas financial centres. However, such a move may complicate the relationship between UK and EU further.

Regarding the effect of Brexit, Ebell and Warren (2016) had argued that the effect of Brexit on the current account of the UK was underestimated. The UK’s current account was already in deficit, and after Brexit, the UK economic prospects for foreign investors will become worse. It will become difficult to attract foreign investors. Therefore, the capital inflows will be discouraged, and it is expected that the current account deficit will increase further. Recent research by Jayakumar (2017) has also analysed the effect of Brexit on the UK’s ability to improve its current account position. It was evident that the UK is a gateway for non-EU investment to enter the EU. The UK current account was already in deficit in the pre-Brexit period, meaning that the current account inflow is less than the outflow. Brexit will render UK unattractive for foreign investors. Therefore, it was doubtful that the UK would improve its current account position in hard Brexit based on the analysis. However, in the case of soft Brexit, it could be possible for the UK to improve its current account position as the current account balance can be improved by the orderly depreciating GBP.

Based on the review, the key evidence from the present empirical literature was identified. It was found that Brexit is likely to create policy uncertainty in the short run. It will change the importance of the UK in the international financial system. The UK will lose passporting rights and single market access to the EU financial markets. The non-EU FDI and other UK investments will be materially impacted due to losing the single market access to the EU financial markets. The trade costs for the UK financial services sector is likely to increase. To compensate for the lost benefit of single market access, the UK may develop greater integration with offshore and overseas financial centres. However, such a move may complicate the relationship between UK and EU further. There are two possible scenarios for Brexit, which are termed soft Brexit and hard Brexit. It was evident that trade costs would increase greatly in the hard Brexit case, while the trade costs may not increase greatly and will be sustainable in the soft Brexit case. In the case of hard Brexit, the UK’s economic prospects for foreign investors will worsen, making it difficult to attract foreign investors. Given this, the capital inflows are expected to be discouraged, and it is doubtful that the UK will improve its current account position. While in the case of soft Brexit, the deprecation of GBP could enable the UK to improve its current account balance, due to which the current account balance could be improved.

However, the literature identified the gap as various aspects were not specifically covered in the empirical literature. For instance, the exact nature of the policy change was not concluded by past researchers. Moreover, the trade costs expected to increase for the UK financial services sector were not measured in terms of amount. The UK and the EU’s financial services sector relationship will be altered after Brexit was not found in the empirical literature. Although two possible Brexit scenarios (hard and soft) were discussed, it was not concluded which of the two scenarios will prove correct in actuality. Given this, it is concluded that there is limited evidence regarding the possible future scenarios of Brexit, and there is still uncertainty regarding the future policy and actual impact of Brexit on the UK financial services sector. Therefore it is worthwhile to conduct empirical research to find the impact of Brexit on the UK financial services sector.

Armstrong, A., & Portes. J. (2016). Commentary: The Economic Consequences of Leaving the EU. National Institute Economic Review, 236, 2-6.

Bush, O., Knott, S., & Peacock, C. (2014). Why Is the UK Banking System So Big and Is That a Problem? Bank of England Quarterly Bulletin, 54, 385-395.

Connington, J. (10 March 2017). How Brexit will affect your money: investments, currency and more. Telegraph. Online; https://www.telegraph.co.uk/investing/isas/brexit-will-affect-money-investments-currency/

Crafts, N. (2016). The Growth Effects of EU Membership for the UK: A Review of the Evidence. Working Paper no. 280. Coventry: the University of Warwick, Centre for Competitive Advantage in the Global Economy.

Ebell, M., & Warren, J. (2016). The long-term economic impact of leaving the EU. SAGE Journals, 236(1), 121-138.

Gannon, F. (2016). Brexit and research: goodbye EU money and colleagues?. EMBO reports 7(9), 1237-1359.

Handley, K, & Limão. N. (2015). Trade and Investment under Policy Uncertainty: Theory and Firm Evidence. American Economic Journal: Economic Policy, 7(4), 189-222.

House of Lords. (, 2017). Brexit: financial services. European Union Committee: 9th Report of Session 2016-17. HL Paper 81. pp. 1-52.

Jayakumar, V. (2017). UK Current Account Sustainability in the Post-Brexit Era: Insights from an Intertemporal Current Account Framework. Theoretical Economics Letters, 7, 223-250.

London First. (June 2016). Leaving the EU: an assessment of its impact on services and trade. Online; http://londonfirst.co.uk/wp-content/uploads/2016/06/Leaving-the-EU-impact-on-trade-June-2016.pdf

Miethe, J., & Pothier, D. (2016). Brexit: What’s at Stake for the Financial Sector?. DIW Economic Bulletin. 6(31), 364-372.

Oliver, T. (2016). European and international views of Brexit. Journal of European Public Policy, 23(9), 1321-1328.

Sahr, D., Compton, M., Carr, A., Wilkes, G., & Behrens, A. (2016). Brexit: what are the options for the financial services industry? Journal of Investment Compliance, 17(4), 45-53, DOI: 10.1108/JOIC-09-2016-0039DOIhttp://dx.doi.org/10.1108/JOIC-09-2016-0039

Sampson, T. (2016). Dynamic Selection: An Idea Flows Theory of Entry, Trade, and Growth. Quarterly Journal of Economics, 131(1), 315-80.

Wilcock, J., & Miller, A. (2016). Brexit: academic catastrophe and publishing opportunity?, Insights, 29(3), 216-223.

Wyman, O. (2016). The impact of the UK’s exit from the EU on the UK-based financial services sector. TheCityUK. Online; https://www.publications.parliament.uk/pa/ld201617/ldselect/ldeucom/81/81.pdf

Armstrong, A., & Portes. J. (2016). Commentary: The Economic Consequences of Leaving the EU. National Institute Economic Review, 236, 2-6.

Bush, O., Knott, S., & Peacock, C. (2014). Why Is the UK Banking System So Big and Is That a Problem? Bank of England Quarterly Bulletin, 54, 385-395.

Connington, J. (10 March 2017). How Brexit will affect your money: investments, currency and more. Telegraph. Online; https://www.telegraph.co.uk/investing/isas/brexit-will-affect-money-investments-currency/

Crafts, N. (2016). The Growth Effects of EU Membership for the UK: A Review of the Evidence. Working Paper no. 280. Coventry: the University of Warwick, Centre for Competitive Advantage in the Global Economy.

Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J. (2016) The Impact of Brexit on Foreign Investment in the UK. CEP Brexit Analysis No. 3. http://cep.lse.ac.uk/pubs/download/brexit03.pdf

Ebell, M., & Warren, J. (2016). The long-term economic impact of leaving the EU. SAGE Journals, 236(1), 121-138.

Gannon, F. (2016). Brexit and research: goodbye EU money and colleagues?. EMBO reports 7(9), 1237-1359.

Handley, K, & Limão. N. (2015). Trade and Investment under Policy Uncertainty: Theory and Firm Evidence. American Economic Journal: Economic Policy, 7(4), 189-222.

House of Lords. (, 2017). Brexit: financial services. European Union Committee: 9th Report of Session 2016-17. HL Paper 81. pp. 1-52.

Jayakumar, V. (2017). UK Current Account Sustainability in the Post-Brexit Era: Insights from an Intertemporal Current Account Framework. Theoretical Economics Letters, 7, 223-250.

London First. (June 2016). Leaving the EU: an assessment of its impact on services and trade. Online; http://londonfirst.co.uk/wp-content/uploads/2016/06/Leaving-the-EU-impact-on-trade-June-2016.pdf

Miethe, J., & Pothier, D. (2016). Brexit: What’s at Stake for the Financial Sector?. DIW Economic Bulletin. 6(31), 364-372.

Oliver, T. (2016). European and international views of Brexit. Journal of European Public Policy, 23(9), 1321-1328.

Sahr, D., Compton, M., Carr, A., Wilkes, G., & Behrens, A. (2016). Brexit: what are the options for the financial services industry? Journal of Investment Compliance, 17(4), 45-53, DOI: 10.1108/JOIC-09-2016-0039DOIhttp://dx.doi.org/10.1108/JOIC-09-2016-0039

Sampson, T. (2016). Dynamic Selection: An Idea Flows Theory of Entry, Trade, and Growth. Quarterly Journal of Economics, 131(1), 315-80.

Wilcock, J., & Miller, A. (2016). Brexit: academic catastrophe and publishing opportunity?, Insights, 29(3), 216-223.

Wyman, O. (2016). The impact of the UK’s exit from the EU on the UK-based financial services sector. TheCityUK. Online; https://www.publications.parliament.uk/pa/ld201617/ldselect/ldeucom/81/81.pdf

If you are the original writer of this Dissertation Proposal and no longer wish to have it published on www.ResearchProspect.com then please:

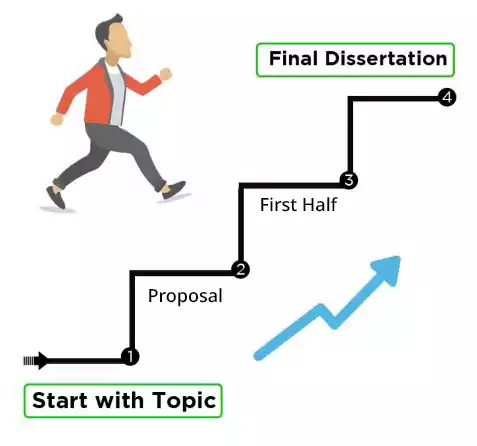

To write an undergraduate dissertation proposal: