Here is a sample that showcases why we are one of the world’s leading academic writing firms. This assignment was created by one of our expert academic writers and demonstrated the highest academic quality. Place your order today to achieve academic greatness.

The following essay is based on the assessment of strategic risk management in an organisation. The coursework aims to discuss whether or not strategic risk management as a holistic approach for managing the risk within an organisation is useful. The organisation that has been selected for undergoing the coursework is British Petroleum.

The different sections of the assignment outline the necessity of strategic risk management and have assessed the factors influencing its implementation. The use of different theories, models and frameworks have supported the discussion in context with British Petroleum. The assignment has presented the conclusion supporting the need for strategic risk management in the petroleum industry for gaining several benefits.

The process of strategic risk management is defined as identifying and assessing the risk that the business may face within its operations and the development of strategies according to the study of Chance and Brooks (2015). Additionally, the purpose of strategic risk management is to ensure that the company is working effectively and has been managing the risks meritoriously by taking precautionary measures for its functions and operations. The following assignment has discussed the need for strategic risk management in the selected company British Petroleum that has been assessed and analysed using secondary sources.

British Petroleum is one of the renowned oil companies that started its operations in 1909 with the Anglo Persian Oil Company and their headquarters is in London. The company has been operating in both the upstream of oil exploration and the downstream of oil refining, sales, and marketing. It is one of the world’s largest companies having more than 22, 400 service stations across the world. The company provides fuel, energy and retail service to its consumers and offers petrochemical products for daily use (British Petroleum Annual Report, 2018).

Within the case of British Petroleum (BP), Gulf of Mexico Oil Spill in 2010 is one of the major events that occurred due to the negligence and the lack of contingency planning in the company. The incident occurred at one of the company’s oil wells where nearly 4.9 million oil barrels were leaked in three months. It had an extreme impact on the environment and the country’s economy that resulted in the decreasing the share price of the company (Sammarco et al., 2016). The issue has also created a higher negative perception among the stakeholders and the general public.

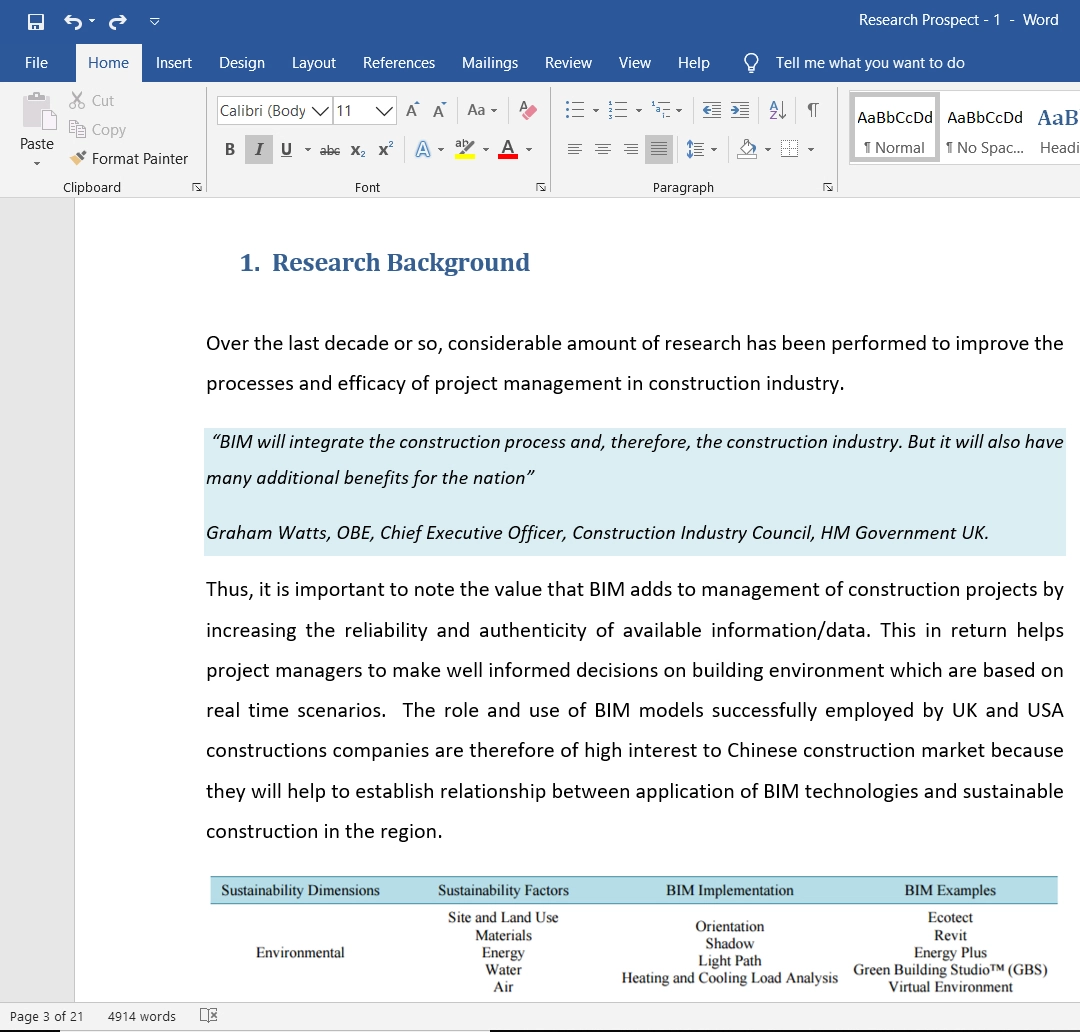

According to the study presented by Neil Allan, John Davis, and Patrick Godfrey (2007), strategic management plays a vital role in managing the risk in an organisation. The study has highlighted some of the key factors that are responsible for managing risk in the company. These factors are provided to be people, process, pattern, performance, and perception of the people and the company. The loss of strategic risk planning may attract several disasters to the company in the short and long run.

Figure 1 Neil Allan, John Davis and Patrick Godfrey (2007)

The figure has provided the identification of different risks that are associated with the companies. Strategic risk management is the holistic approach for the effective management of the risk in the companies. The study of Larkin (2003) has also presented the concept and application of strategic risk management within the companies that can create a difference in the company’s compliance and governance. Additionally, the study of Bromiley et al (2015) has emphasized the absence of strategic risk management that can create hurdles within the firm’s operations and develop the company’s negative perception in the global world.

The study conducted by Slagmulder and Devoldere (2018) has also mentioned the need for strategic risk management that can sustain the uncertainty for assessing different capabilities of the company that can affect the company’s performance. It demonstrates the company’s capabilities for assessing and managing the risk that can be faced in the long run and the short run within different operations.

According to the company’s annual report, it has been mentioned that the company utilizes the methods of the risk management and uses their abilities for managing the faced uncertainties within the firm (BP Annual Report, 2018). The company’s risk management system is understood with the environment and is assessed in the best possible way to treat the company’s potential exposure. British Petroleum conducts several risk management activities necessary for managing the different identified and expected risks of the company (BP Annual Report, 2018). The risk management activities of the company are provided below;

Figure 2 risk management activities (BP annual report, 2018)

The management and staff of the company identify and operate the risks daily in terms of the management and promotion of the risk for carrying out the proper operations. Additionally, strategic risk management is highly effective in meeting the company’s requirements in terms of the laws and regulations provided by the government and the regulatory body. The effective use of strategic risk management allows the company to carry out the sustainable operations and minimise the negative impact of the risk on the daily operations (BP annual report, 2018).

The management and the operations of the company are effectively managed in terms of the functions and integrations of the strategies that are applied in the company for better performance and resources. The company has a defined standard and utilises the risk management activities to improve the previous operations and plan the new activities in the long run. Additionally, according to the study conducted by Rugby (n.d), the company can utilize the sources and can develop the means of mitigating the hurdles and hazards in the company for effective functions and operations.

The effective use and implementation of strategic risk management allow the company to act upon the governance standards and regulations. The company assesses and manages the risk in an effective manner that can be according to the government and the authorities’ policies and activities. Additionally, as discussed in the company’s Annual report, the company’s auditing team overlooks and assures the proper risk management system for the appropriate designs and assessment of the risk that is significantly related to British Petroleum.

British Petroleum has its own effective risk and governance committees to assess and control the risk factors for different aspects of the company. It has been observed that the company has its executive committee for the management of different risks in terms of strategic and commercial risk, health, safety, security, environment, and operational risk, financial reporting risk, employee risk and the risk for taking further investment decision (BP Annual Report, 2018). Additionally, the company has different board and committees for the audit, safety and another geopolitical committee for the company’s risk management.

Orders completed by our expert writers are

Even though the company has been operating well and has been creating a better image globally, some of the company’s major internal operational risks for long-term sustainability. The assessment has been made using the enterprise risk management that can provide with the core areas of internal and operational management for the British Petroleum and the business’s risks in the long run.

The enterprise risk management is associated with the overall organisation for the internal and external operations that are there to develop and implement strategies in the long run. According to the study conducted by Fraser and Simkins (2010), there are several internal and external effects of the company that comprise the assessment of events related to the company’s risk management.

Different categories of the enterprise risk management creates the control in different aspects. Mcneil (2013) has also discussed the enterprise risk management’s different objectives that include the strategic, operational, and reporting and compliance risks under the single head. The company’s strategic goals and objectives are directly associated with the company’s overall goals in the long run.

However, the authors have also presented the contrary arguments related to the company’s limitations due to the absence of the strategic risk management. Some of the major risks that have been identified in the company are related to the ethical misconduct and having the threat of non-compliance.

Additionally, as discussed in the company’s annual report, there are several risk factors for British Petroleum that can affect its performance and create the negative perception in the global world (BP Annual Report, 2018). Some of the company’s major internal risks include; Process safety, personal safety, environmental safety risks, Financial reporting risks, Drilling and production risk, Environmental and other uncertainties, Transportation and delivery risks, and Product quality risk.

Several companies utilize the methods of strategic risk management using the framework that can be used to assess the risk and identify the appropriate measures of risk that can create the difference within the companies. Strategic risk management can be highly effective for creating better options and developing the contingency plan for the risk management.

Additionally, the study of Sheedy, Griffin, and Barbour (2017) has presented the framework for assessing risk and implementing proper strategies for managing the risk in the company. The strategic framework for the risk has been presented and has been explained under within the context of British Petroleum that can reduce the risks and can take certain actions for the ;

Figure 3 – 1 Strategic Risk Management Framework

The first step is to assess and analyze the strategic position of the company. The company must follow the strategic risk management framework for managing and evaluating the performance of the company. The next step in the framework is to meet the shareholders’ expectations.

Figure 4 – 2 Strategic Risk Management Frameworks

Furthermore, the step is to scan the environment of the company.

Figure 5 – 3 Strategic Risk Management Frameworks

It supports in scanning and evaluating different internal and external strategies for the company to manage the risks.

Figure 6 – 4 Strategic Risk Management Frameworks

The company can also conduct the SWOT analysis to determine the risks that can be gained through the SWOT analysis of the company.

Figure 7 – 5 Strategic Risk Management Frameworks

The use of strategy formulation within the company is to achieve the company’s objectives that can create the different strategies and policies and help achieve the company’s mission and vision.

Figure 8 – 6 Strategic Risk Management Frameworks

The step of having the strategy implementation is necessary for the operational planning in terms of programs, budgets and the procedures for the risk assessment and analysis.

Figure 9 – 7 Strategic Risk Management Frameworks

Furthermore, the last step of evaluation and control organizes and directs the plan efficiently and effectively for the identification of the strategic plans and identifying the new opportunities and risks for the development of strategic reviews and having the proper contingency plan for the future risks and supporting the strategic risk management of the company.

Within the context of British Petroleum, it has been observed that strategic risk management is highly effective in avoiding the problems of recognising the risks of the company that can occur in the long run. It has been observed that the use of strategic risk management can be effective for the company to assess the company in terms of internal and external factors of the company.

Based on the study of Niknejad and Petrovic (2016), the use of strategic risk management allows the company to gain the benefits of increasing their overall productivity and conducting the operations under the assessment of risk for the company to avoid any sort of negativity within the company in the long run. There are several studies conducted by different researchers regarding the challenges that can be faced by the business towards their goal attainment (Baron, Mueller and Wolfe, 2016).

On the other hand, it has been highly recommended for the companies to carry out the effective strategic risk management to minimise the hurdles and issues towards completing the tasks. British Petroleum can benefit from strategic risk management in terms of having the assessment of the investment and the proper implementation of strategies towards the long-term success (Obuchowski, 2006). The use of such strategies can also ensure a competitive advantage in the long run and in developing a differentiated position in the global market.

Planning and implementing the strategic risk management strategies are necessary for the companies to carry out the company’s contingency plans to gain profitability in the long run. However, certain factors in the companies provide certain limitations for the implementation of the strategies for long-term growth and sustainability.

Based on the study of NDAMBUKI (2016), some of the most commonly observed factors responsible for influencing the implementation of strategies. These are the changes in culture, personnel training, organisational resources, communities and the implementation of the strategic risk management are among the common factors that restrict the companies in implementing risk management strategies in the companies.

Within British Petroleum, the company has a differentiated position for the risk assessment and controlling of the activities for the individual aspects. Additionally, the corporate governance and the implementation of laws and regulations allow British Petroleum to control and assess the requirements for the individual segments in an effective manner.

As discussed in the company’s annual report, the ability to act upon the strategies could also negatively affect the company and its position if it is not controlled in an effective manner (BP Annual Report, 2018). British Petroleum has the strategies to implement the new technologies that can enhance the business process and operations. However, there are certain areas and geographical locations that are not advanced for the use of technology. It is also one of the major limitations that the company can face while adopting risk management strategies.

The following assignment is based on the strategic risk management of the selected company British Petroleum that has been assessed and analysed using the different aspects of the risk management used by the company to manage the company’s risk. The study has emphasised identifying the risk that is there within the company and the strategies that can be used for mitigating these risks.

It has been evaluated that the company has faced a massive challenge in terms of the case of the Mexico Oil spill that has negatively influenced the position of the company. However, the use of such strategic risk management strategies for controlling the risks in different operations has created the positive influence towards mitigating the company’s risks.

The analysis has provided the assessment that the company utilizes the different strategies for identifying, controlling, and minimising the company’s upcoming risks. The last section of the assignment has provided the limitations and benefits of the British Petroleum for the implementation of the risks strategies to control the company’s challenges.

Baron, R.A., Mueller, B.A. and Wolfe, M.T., 2016. Self-efficacy and entrepreneurs’ adoption of unattainable goals: The restraining effects of self-control. Journal of Business Venturing, 31(1), pp.55-71.

British Petroleum Annual Report (2018). [online] Available at: https://www.bp.com/content/dam/bp/en/corporate/pdf/investors/bp-annual-report-and-form-20f-2017.pdf [Accessed 4 Oct. 2018].

Bromiley, P., McShane, M., Nair, A. and Rustambekov, E., 2015. Enterprise risk management: Review, critique, and research directions. Long range planning, 48(4), pp.265-276.

Chance, D.M. and Brooks, R., 2015. Introduction to derivatives and risk management. Cengage Learning.

Fraser, J., and Simkins, B., 2010. Enterprise risk management. Hoboken, N.J.: Wiley.

Larkin, J. 2003. Strategic reputation risk management. Basingstoke: Palgrave Macmillan.

Mcneil, A. 2013. Enterprise Risk Management. Annals of Actuarial Science, 7(1), 1–2. doi:10.1017/S1748499512000334

NDAMBUKI, W.N., 2016. FACTORS AFFFECTING THE SUCCESSFUL IMPLEMENTATION OF ENTERPRISE RISK MANAGEMENT IN KENYAN REGULATORY AUTHORITIES.

Neil Allan, John Davis, and Patrick Godfrey. 2007. Ten steps to managing strategic risk—a holistic approach. Proceedings of the ICE – Civil Engineering, 160(3), 137–143. doi:10.1680/cien.2007.160.3.137

Niknejad, A., and Petrovic, D., 2016. A fuzzy dynamic Inoperability Input–output Model for strategic risk management in Global Production Networks. International Journal of Production Economics, 179(C), 44–58. doi:10.1016/j.ijpe.2016.05.017

Obuchowski, J. 2006. The Strategic Benefits of Managing Risk. MIT Sloan Management Review, 47(3), 6–7. Retrieved from https://www.proquest.com/docview/224962096

safe handling of light ends : a collection of booklets describing hazards and how to manage them. (n.d.). ([5th ed.].). Rugby, UK: British Petroleum/Institution of Chemical Engineers.

Sammarco, P.W., Kolian, S.R., Warby, R.A., Bouldin, J.L., Subra, W.A. and Porter, S.A., 2016. Concentrations in human blood of petroleum hydrocarbons associated with the BP/Deepwater Horizon oil spill, Gulf of Mexico. Archives of toxicology, 90(4), pp.829-837.

Sheedy, E.A., Griffin, B. and Barbour, J.P., 2017. A framework and measure for examining risk climate in financial institutions. Journal of Business and Psychology, 32(1), pp.101-116.

Slagmulder, R., and Devoldere, B., 2018. Transforming under deep uncertainty: A strategic perspective on risk management. Business Horizons, 61(5), 733–743. doi:10.1016/j.bushor.2018.05.001

Strategic Management Framework., 2018. [online] Available at: https://www.icwa.wa.gov.au/__data/assets/pdf_file/0016/7117/Risk-Management-Strategic-Management-Framework.pdf [Accessed 4 Oct. 2018].

Strategic risk management.(Brief article). (n.d.).Business Insurance, 46(35).

Zou, X., Scholer, A.A. and Higgins, E.T., 2014. In pursuit of progress: Promotion motivation and risk preference in the domain of gains. Journal of personality and social psychology, 106(2), p.183.

To complete undergraduate coursework: